Top Android Apps for Personal Finance: Manage Your Money with Ease

Managing personal finances can be a daunting task, but thanks to the advancements in technology, we now have a wide range of Android apps that can help us stay on top of our financial goals. Whether you want to track your expenses, create budgets, or invest wisely, there is an app out there to suit your needs. In this comprehensive guide, we will explore the top Android apps for personal finance and how they can empower you to take control of your financial life.

Expense Tracker: Keep a Close Eye on Your Spending Habits

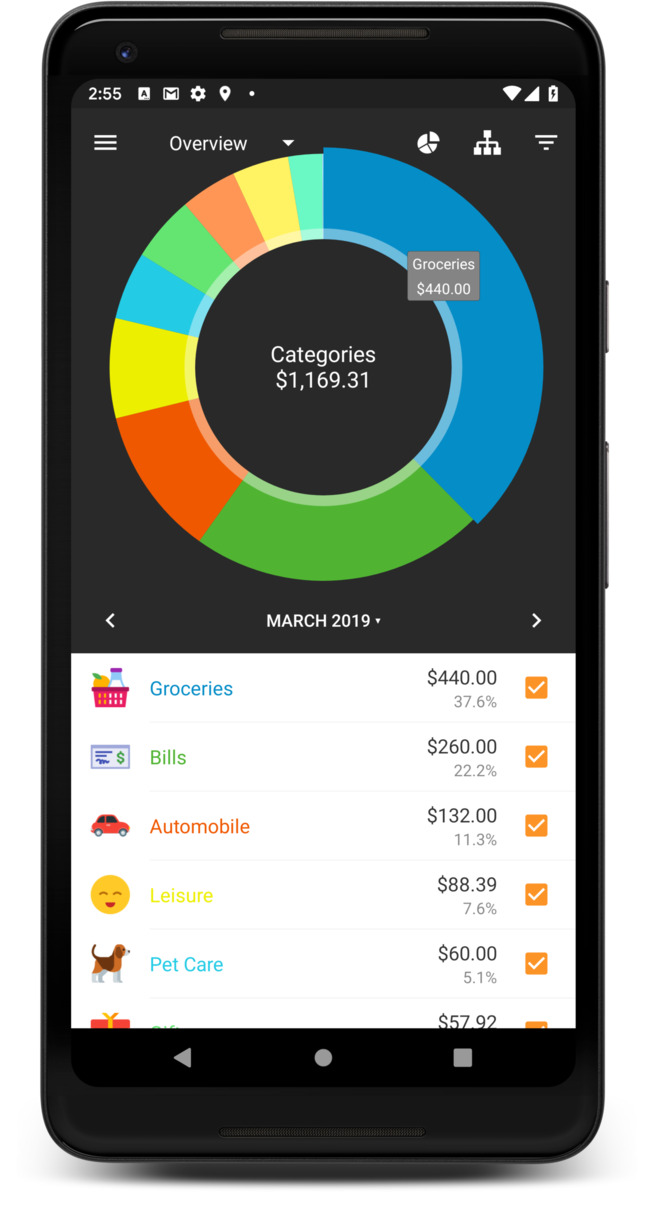

With this handy app, you can gain a deeper understanding of your spending habits and make more informed financial decisions. The expense tracker allows you to categorize your expenses, set budgets, and even receive alerts when you exceed your limits. By visually representing your spending patterns through detailed graphs and reports, you can easily identify areas where you may be overspending and make necessary adjustments. This app provides a comprehensive overview of your financial health and acts as a powerful tool to help you achieve your financial goals.

Features:

- Categorize expenses: This feature allows you to classify your expenses into different categories such as groceries, utilities, entertainment, and more. It gives you a clear picture of your spending patterns and helps you identify areas where you can cut back.

- Budget setting: With the budget setting feature, you can set spending limits for different categories and track your progress. The app sends you alerts when you are approaching or exceeding your set limits, enabling you to make more conscious spending decisions.

- Graphical representations: The app provides detailed graphs and charts to visualize your spending habits over time. You can see how your spending patterns fluctuate from month to month, identify trends, and make adjustments accordingly.

- Expense reports: Generate comprehensive expense reports that break down your spending by category, time period, or merchant. These reports provide valuable insights into your spending habits, allowing you to make informed decisions about where to cut back and save.

- Sync across devices: Many expense tracker apps offer synchronization across multiple devices, ensuring that you can access your financial information and track your expenses from anywhere, anytime.

Budget Planner: Take the Guesswork Out of Budgeting

Creating and maintaining a budget is crucial for financial success, and the budget planner app is designed to simplify this process. It helps you create personalized budgets based on your income and expenses, ensuring that you allocate your money wisely and stay on track. With this app, you can say goodbye to the guesswork and hello to financial freedom.

Features:

- Income and expense tracking: The budget planner app allows you to track your income from various sources and your expenses across different categories. It gives you a clear picture of your financial inflows and outflows, making it easier to create a budget that aligns with your financial goals.

- Customizable budget categories: Customize your budget categories to suit your unique needs and spending habits. You can create categories for essentials like rent, groceries, and utilities, as well as discretionary expenses like dining out and entertainment.

- Budget alerts and reminders: Set budget alerts and reminders to stay on track with your spending goals. The app sends notifications when you are approaching or exceeding your budget limits, helping you make conscious decisions about your expenses.

- Savings goals: The budget planner app allows you to set savings goals and track your progress towards achieving them. Whether you're saving for a vacation, a down payment on a house, or an emergency fund, this feature keeps you motivated and focused on your financial objectives.

- Expense analysis: Gain insights into your spending patterns through detailed expense analysis. The app provides visual representations of your spending habits, allowing you to identify areas where you can cut back and save more.

Investment Portfolio Manager: Your Ultimate Investment Companion

Investing wisely is key to building wealth, and the investment portfolio manager app is designed to simplify the process. Whether you're a seasoned investor or just starting out, this app provides you with the tools and insights you need to make informed investment decisions and maximize your returns.

Features:

- Real-time stock tracking: Keep a close eye on your investments with real-time stock tracking. The app allows you to monitor the performance of your stocks, bonds, and mutual funds, ensuring that you stay informed about market trends and make timely investment decisions.

- Portfolio analysis: Analyze the performance of your investment portfolio with comprehensive analysis tools. The app provides insights into your portfolio's allocation, diversification, and risk exposure, helping you make adjustments to optimize your returns.

- Investment recommendations: Receive personalized investment recommendations based on your risk tolerance, financial goals, and time horizon. Whether you're looking for long-term growth or short-term gains, this feature guides you towards investment opportunities that align with your objectives.

- Research and news updates: Stay up to date with the latest market news and research reports. The app provides access to financial news, analyst reports, and company updates, ensuring that you have the information you need to make informed investment decisions.

- Performance tracking: Track the performance of your investments over time. The app provides detailed performance metrics, including total returns, annualized returns, and portfolio growth, allowing you to evaluate the success of your investment strategy.

Bill Reminder: Never Miss a Payment Again

Missing bill payments can lead to late fees and negatively impact your credit score. The bill reminder app ensures that you stay on top of your bills and never miss a payment again. With this app, you can say goodbye to the stress of bill payments and hello to peace of mind.

Features:

- Bill tracking: The app allows you to track your bills, due dates, and payment history in one convenient location. You can add recurring bills and one-time bills, ensuring that you never miss a payment.

- Payment reminders: Set reminders for upcoming bill payments. The app sends you notifications and alerts, ensuring that you have adequate time to make the payment before the due date.

- Multiple payment methods: The bill reminder app supports multiple payment methods, allowing you to pay your bills directly through the app. You can link your bank account or credit card for seamless bill payments.

- Payment history: Keep a record of your payment history for each bill. The app allows you to view past payments, ensuring that you have a clear overview of your financial obligations.

- Late fee avoidance: By ensuring timely bill payments, the app helps you avoid late fees, which can add up over time and impact your financial well-being.

Debt Snowball Calculator: Create a Strategic Plan to Become Debt-Free

If you're struggling with debt, the debt snowball calculator app can help you create a strategic plan to become debt-free. It analyzes your debts, interest rates, and repayment options to provide you with a personalized debt payoff plan. With this app, you can take control of your finances and pave the way to a debt-free future.

Features:

- Debt analysis: The app analyzes your debts, including balances, interest rates, and minimum monthly payments. It provides a comprehensive overview of your debt situation, allowing you to prioritize your debts and create a strategy for repayment.

- Debt payoff plan: Based on your financial information, the app generates a personalized debt payoff plan. It calculates the optimal repayment strategy, such as the debt snowball or debt avalanche method, to help you pay off your debts efficiently.

- Payment simulations: The app allows you to simulate different payment scenarios and see how they impact your debt payoff timeline. You can adjust your monthly payments or allocate additional funds towards debt repayment to evaluate the potential savings and time reduction.

- Progress tracking: Track your progress as you pay off your debts. The app provides visual representations of your debt reduction, allowing you to celebrate milestones and stay motivated on your journey towards financial freedom.

- Savings recommendations: The app offers recommendations on how to optimize your savings while paying off your debts. It suggests strategies to build an emergency fund or save for future expenses, ensuring that you strike a balance between debt repayment and saving for the future.

Tax Calculator: Simplify the Tax Filing Process

Tax season can be overwhelming, but the tax calculator app simplifies the process by calculating your estimated tax liability based on your income and deductions. It can also help you stay organized by tracking your expenses and receipts throughout the year. Say goodbye to last-minute tax woes and hello to stress-free filing.

Features:

- Income calculation: The app calculates your taxable income based on your earnings, deductions, and exemptions. It considers various income sources, such as salary, investments, and self-employment income, ensuring accurate calculations.

- Deduction and credit eligibility: Determine your eligibility for deductions and tax credits. The app guides you through the process and ensures that you maximize your tax savings by taking advantage of all available deductions and credits.

- Expense tracking: Track your expenses and receipts throughout the year. The app allows you to categorize expenses, attach receipts, and store them securely. This feature ensures that you have all the necessary documentation when it's time to file your taxes.

- Estimated tax liability: Based on your financial information, the app calculates your estimated tax liability. It provides an overview of your tax obligation, allowing you to plan and budget accordingly.

- Tax filing reminders: Set reminders for

Tax Calculator: Simplify the Tax Filing Process (continued)

- Tax filing reminders: Set reminders for important tax deadlines. The app sends notifications to ensure that you don't miss any crucial dates, whether it's the deadline for filing your return or making estimated tax payments.

- Tax forms and resources: Access a library of tax forms and resources to assist you in the filing process. The app provides easy access to commonly used forms, instructions, and tax guides, ensuring that you have the necessary information at your fingertips.

- Integration with tax software: Many tax calculator apps integrate with popular tax software programs, making it seamless to transfer your financial data and complete your tax return. This eliminates the need for manual data entry and saves you time and effort.

Savings Goal Tracker: Stay Motivated and On Track

Whether you're saving for a dream vacation, a down payment on a house, or an emergency fund, the savings goal tracker app keeps you motivated and on track. It allows you to set savings goals, track your progress, and celebrate milestones along the way. With this app, you'll be one step closer to achieving your financial dreams.

Features:

- Goal setting: Set savings goals for different purposes. Whether it's short-term goals like buying a new gadget or long-term goals like saving for retirement, the app allows you to define your objectives and allocate funds accordingly.

- Progress tracking: Track your progress towards your savings goals. The app provides visual representations of your savings growth, allowing you to see how close you are to achieving your objectives. This feature keeps you motivated and encourages you to stay committed to your saving habits.

- Savings reminders: Set reminders to save. The app sends notifications or alerts to remind you to allocate funds towards your savings goals. This helps you stay consistent with your savings habits and prevents you from forgetting or neglecting your goals.

- Milestone celebrations: Celebrate milestones along the way. The app allows you to mark significant achievements, such as reaching a specific savings amount or completing a savings goal. This feature provides a sense of accomplishment and encourages you to continue working towards your financial aspirations.

- Savings tips and strategies: Access a wealth of savings tips and strategies within the app. It offers guidance on how to cut expenses, increase income, and optimize your savings potential. These resources help you make the most of your savings journey and achieve your goals faster.

Retirement Planner: Start Planning for a Comfortable Retirement

It's never too early to start planning for retirement, and the retirement planner app makes it easier than ever. It helps you calculate how much you need to save, based on your desired retirement age and lifestyle. With personalized savings strategies and investment tips, you can ensure a comfortable retirement.

Features:

- Retirement savings calculator: The app calculates how much you need to save for retirement based on various factors, including your desired retirement age, expected expenses, and estimated lifespan. It provides a target savings amount to work towards, giving you a clear goal to strive for.

- Savings strategies: The retirement planner app offers personalized savings strategies to help you reach your retirement goals. It suggests contribution amounts, investment options, and savings milestones to keep you on track.

- Investment recommendations: Receive investment recommendations tailored to your retirement goals. The app provides insights into suitable investment vehicles, such as individual retirement accounts (IRAs), 401(k) plans, or mutual funds, helping you build a diversified portfolio that aligns with your risk tolerance and time horizon.

- Retirement income projections: Estimate your retirement income based on your savings, investments, and expected Social Security benefits. The app provides projections of your future income, allowing you to evaluate whether it will be sufficient to support your desired lifestyle during retirement.

- Adjustments and scenarios: Explore different retirement scenarios and adjust variables to see the impact on your savings and income projections. This feature allows you to make informed decisions about your retirement planning and adjust your strategy if needed.

Credit Score Tracker: Monitor and Improve Your Credit Health

Your credit score plays a crucial role in your financial well-being, and the credit score tracker app helps you keep tabs on it. It provides real-time updates on your credit score, along with tips to improve it. With this app, you can monitor your credit health and take steps towards a brighter financial future.

Features:

- Credit score monitoring: The app provides real-time updates on your credit score from major credit bureaus. It allows you to track changes in your score and identify any potential issues or discrepancies that may affect your creditworthiness.

- Credit report access: Access your credit report within the app. Review your credit history, account details, and payment history to ensure accuracy and identify areas that need improvement.

- Score factors analysis: Understand the factors that influence your credit score. The app analyzes your credit report and provides insights into the key factors impacting your score, such as payment history, credit utilization, length of credit history, and more.

- Credit improvement tips: Receive personalized tips and recommendations to improve your credit score. The app offers guidance on how to establish good credit habits, pay off debts, and manage your credit responsibly.

- Credit monitoring alerts: Set up alerts for important credit events, such as changes in your credit score, new accounts opened in your name, or late payment notifications. This feature ensures that you stay informed about any potential identity theft or credit fraud.

Expense Sharing: Simplify Bill Splitting with Friends or Roommates

Splitting bills with friends or roommates can be a hassle, but the expense sharing app simplifies the process. It allows you to track shared expenses and settle debts effortlessly, eliminating the need for manual calculations and ensuring that everyone pays their fair share.

Features:

- Shared expense tracking: The app allows you to track shared expenses among multiple individuals. You can enter the details of each expense, including the amount, category, and the individuals involved.

- Expense splitting calculations: The app automatically calculates each person's share of the expenses, based on pre-defined rules or custom settings. It eliminates the need for manual calculations and ensures that everyone contributes proportionally.

- Settlement tracking: Keep track of who owes what and settle outstanding balances with ease. The app provides a clear overview of each individual's debts and facilitates seamless settlement through various payment methods.

- Expense history: Maintain a record of all shared expenses and settlements. The app allows you to view past transactions, track spending patterns, and analyze shared expenses over time.

- Group expense management: The app offers group expense management features, allowing multiple individuals to track and split expenses within a shared group. This is particularly useful for roommates, friends, or colleagues who often share expenses.

In conclusion, these Android apps for personal finance offer a wide range of features to help you manage your money with ease. From tracking expenses and creating budgets to investing wisely and planning for retirement, there is an app for every aspect of your financial life. Download these apps today and take the first step towards achieving your financial goals.

Post a Comment for "Top Android Apps for Personal Finance: Manage Your Money with Ease"